M-PESA is Africa's most successful mobile money service. In the ever-evolving landscape of digital finance and mobile payment solutions, M-PESA stands out as a game-changer for travelers exploring the vast and diverse continent of Africa. Using M-PESA while traveling through Africa makes it exceptionally easy to securely transfer money, make purchases, top-up airtime, and pay bills from your mobile device.

As Africa travel specialists, seasoned SEO experts and top-tier copywriters, we understand the importance of offering you content that not only informs but elevates your understanding of why M-Pesa is the quintessential choice for travelers navigating Africa and how it works. Reflecting on my first experiences as a traveler in Africa, the concept of a mobile money service was new terrain for me, and figuring out how to use M-Pesa felt like a puzzle. For your convenience, I'll break down how M-Pesa works, and how to get an M-pesa account in 9 simple steps to make your travels in Africa smoother while managing money on the go.

What is M-Pesa?

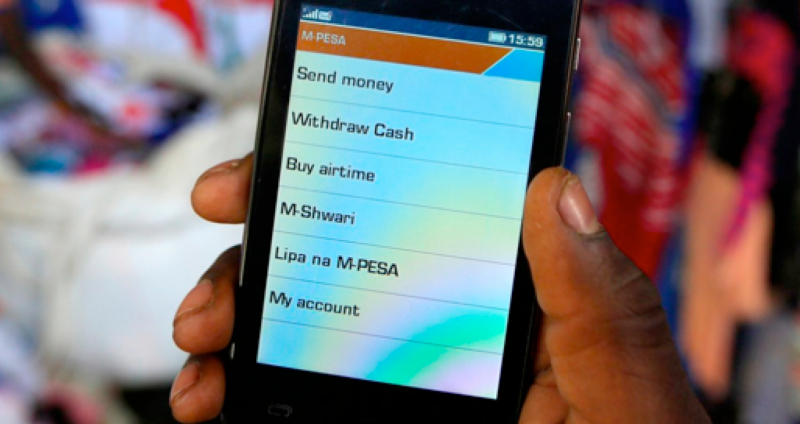

M-PESA (M for mobile, PESA means money in Swahili) is a mobile money service that allows users in Kenya and other African countries like Tanzania to deposit, withdraw, transfer money, top-up airtime, pay for goods and services, and even take out loans.

Mpesa Kenya was launched in 2007 by Vodafone and Safaricom, the largest mobile network operator in Kenya and Vodafone's Kenyan associate. In early 2020, Vodacom and Safaricom completed the acquisition of the M-PESA brand from Vodafone Group through a newly created joint venture. M-Pesa offers its services in 10 African countries so far. This mobile money service is the preferred way to make payments across the continent both for the banked and unbanked due to its safety and unmatched convenience.

In what countries can you use M-Pesa?

You can use M-Pesa in several countries across Africa and beyond. M-Pesa is available in Kenya, Tanzania, Mozambique, Democratic Republic of Congo (DRC), Lesotho, Ghana, Egypt, Afghanistan, South Africa, and Ethiopia.

The Vital Role of M-Pesa in Financial Inclusion and Accessibility

In regions where traditional banking services are inaccessible to the majority, the mobile phone-based money transfer service M-Pesa becomes notably significant. M-Pesa plays a transformative role in extending financial services to millions of individuals who possess mobile phones but lack access to conventional banking or have limited banking services.

With over 51 million customers across seven African countries, M-Pesa offers a safe, secure, and affordable means to send and receive money, top-up airtime, make bill payments, receive salaries, obtain short-term loans, and much more. Acting as a game-changer, M-Pesa effectively bridges the financial gap by providing a user-friendly platform widely accepted across communities. This accessibility is especially crucial in rural and underserved areas, empowering individuals who might otherwise be excluded from the formal financial system.

Why do I need Mpesa when traveling in Africa?

As a traveler, M-Pesa is convenient for two crucial reasons. Firstly, the service offers quick and secure money transfers to send money to another person or to make purchases. Secondly, M-Pesa ensures that your phone remains reliably topped up with airtime. Especially when you’re traveling in remote areas or on a safari, you might not find banks to withdraw money or shops to buy airtime for your phone. By using Mpesa as a traveler, you can transfer money or top up your phone with airtime, ensuring you stay connected without any hassles, and making sure you can keep calling, texting, and using data when traveling.

M-Pesa is becoming the preferred and sometimes the only option for online purchases. For example, in Kenya, I found out that buying a bus ticket online from Nairobi to Narok with Easy Coach was only possible through M-Pesa. There were no other payment options available on the platform, highlighting the widespread use and importance of M-Pesa for online transactions in the country.

How does Mpesa work?

M-Pesa is a simple and convenient mobile money service that works by allowing users to upload money to their accounts through authorized agents. Once the money is uploaded, users can make various transactions, such as sending and receiving money, paying bills, and buying airtime, all directly from their mobile phones. The process is secure and user-friendly, with transactions protected by a personal identification number (PIN).

Mpesa charges

Traveling in Africa shouldn't break the bank, and M-Pesa ensures it doesn't. With minimal transaction fees and competitive exchange rates, M-Pesa optimizes your travel budget, enabling you to allocate resources where they matter the most - creating lasting memories and embracing the adventure.

M-Pesa charges vary depending on the transaction amount and whether you are sending or receiving money, but generally the fees are very reasonable and significantly lower than traditional banking fees. You can check the M-Pesa charges on the M-Pesa app or by visiting an M-Pesa agent.

Step-by-step guide on how to get an M-Pesa account

How to use M-Pesa as a traveler? To get started with M-Pesa, you need to register with a mobile operator that offers the service and then deposit money into your M-Pesa account. Here’s a step-by-step guide:

Step 1: Check Availability

Before you start, ensure that M-Pesa services are available in the African country you are visiting. With 604,000 active agents operating across the Democratic Republic of Congo (DRC), Egypt, Ghana, Kenya, Lesotho, Mozambique, and Tanzania, M-Pesa is widely used in many African countries, but it's always good to confirm.

Step 2: Visit a Safaricom Agent or M-Pesa Store

Safaricom is the telecommunications company that operates M-Pesa. Look for a Safaricom agent or an M-Pesa store in the area you are visiting. These are often found in urban centers, shopping malls, and other high-traffic locations.

Step 3: Provide Identification Documents

To register for an M-Pesa account, you will typically need to provide identification documents. This includes your passport and sometimes additional documents like proof of address. The specific requirements may vary by country, so it's advisable to check in advance.

Step 4: Fill out the Registration Form

The Safaricom agent will provide you with a M-Pesa registration form. Fill out the form with accurate information. This may include personal details such as your name, phone number, and address.

Step 5: Buy a SIM Card

If you don't already have a local SIM card, the Safaricom agent will provide you with one. This SIM card will be linked to your M-Pesa account.

Step 6: Link your phone number to M-Pesa

Once you have the local SIM card, the agent will assist you in linking your phone number to your new M-Pesa account. This is a crucial step, as your phone number is the primary identifier for M-Pesa transactions.

Step 7: Set a PIN

You will need to set a secure PIN (Personal Identification Number) for your M-Pesa account. This PIN is required for all transactions, so choose a PIN that is easy for you to remember but difficult for others to guess. Remember to keep your M-Pesa PIN confidential and be aware of security measures to protect your account. If you encounter any issues or have questions, don't hesitate to ask the Safaricom agents for assistance.

Step 8: Deposit money into your M-Pesa account

Now that your M-Pesa account is set up, you can deposit money into it. Safaricom agents can assist you in loading cash onto your M-Pesa account, or you can use other supported methods like bank transfers or card payments. Once processed, you'll receive a confirmation SMS, and you can check the updated balance on your phone or through the M-Pesa menu. Easy and convenient!

Step 9: Start using M-Pesa

You now have an active M-Pesa account. You can use it for various transactions, including sending and receiving money, paying bills, buying airtime, and more. Furthermore, you can even use the M-Pesa app to make things even easier!

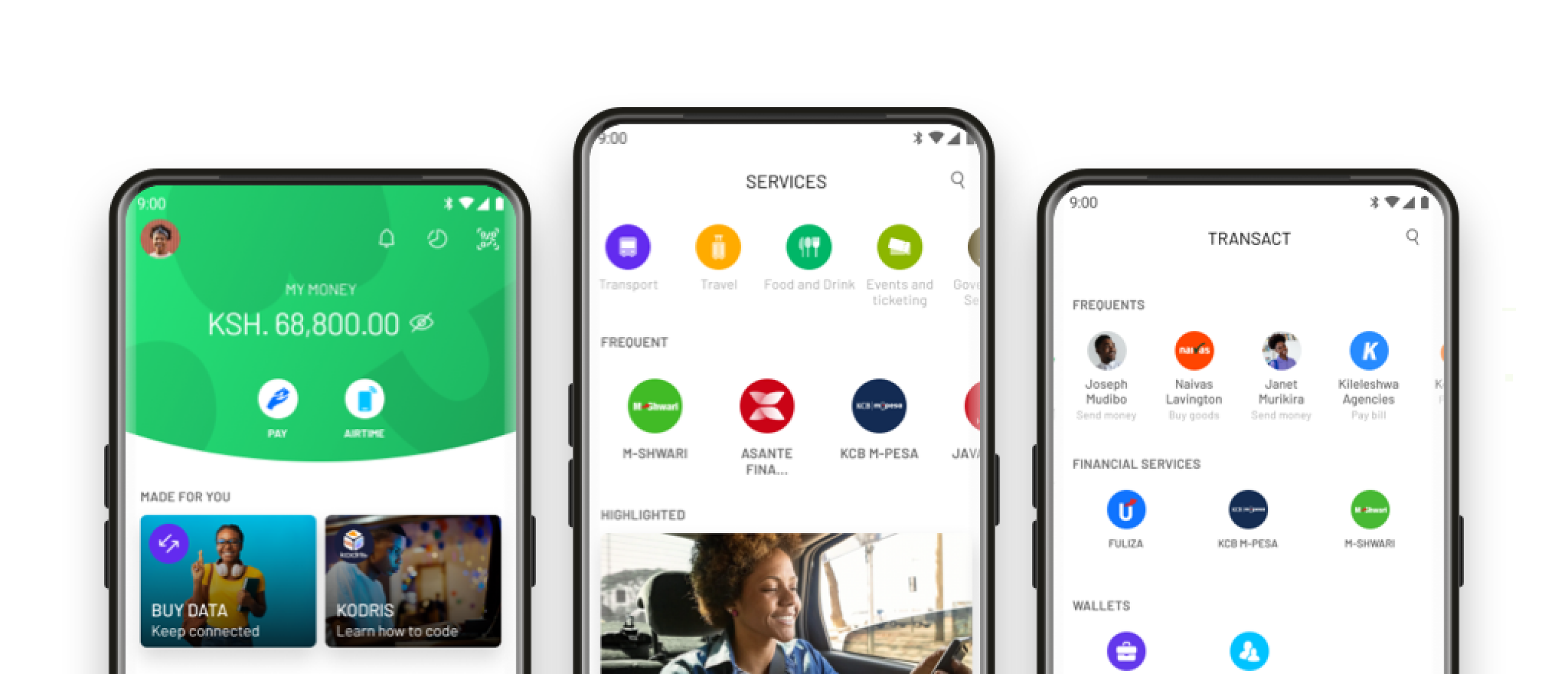

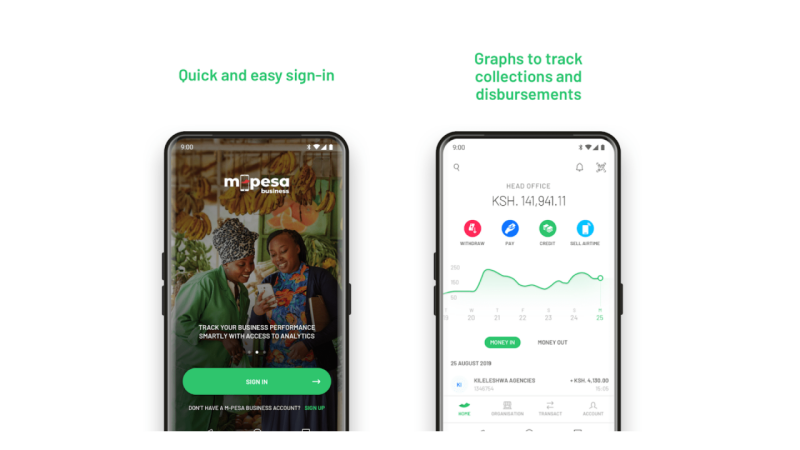

M-Pesa App

The M-Pesa app is a convenient way to manage your M-Pesa account. You can use the app to check your balance, send and receive money, pay bills, and access other M-Pesa services. To download the app, visit the Google Play Store or App Store and search for M-Pesa.

M-Pesa Global, allows users to use the same M-Pesa app in multiple countries. This service is available in all countries except for sanctioned countries like North Korea and Syria. So, whether you are in Kenya, Tanzania, Ghana, Egypt, or any other country where M-Pesa operates, you can use the same M-Pesa app for your transactions.

Safely Manage Your Money with M-Pesa While Traveling in Africa

With M-Pesa, you can manage your money safely, conveniently, and at a low cost while traveling through Africa. Also as a tourist, you can easily get an M-Pesa account. Follow our step-by-step guide to easily set up your Kenya M-Pesa account and experience the seamless convenience of mobile money services while navigating this stunning East African destination. Be sure to take advantage of this mobile money service and experience the convenience and security of mobile money.

Get in touch if you have more questions about using MPESA for traveling in Africa.